Saving money can sometimes feel overwhelming, especially when faced with the demands of daily expenses. However, creative challenges like the 100 Envelope Savings Challenge make saving money both fun and achievable. In this article, we’ll explore how this popular challenge works, why it’s effective, and how you can customize it to suit your financial goals.

What Is the 100 Envelope Savings Challenge?

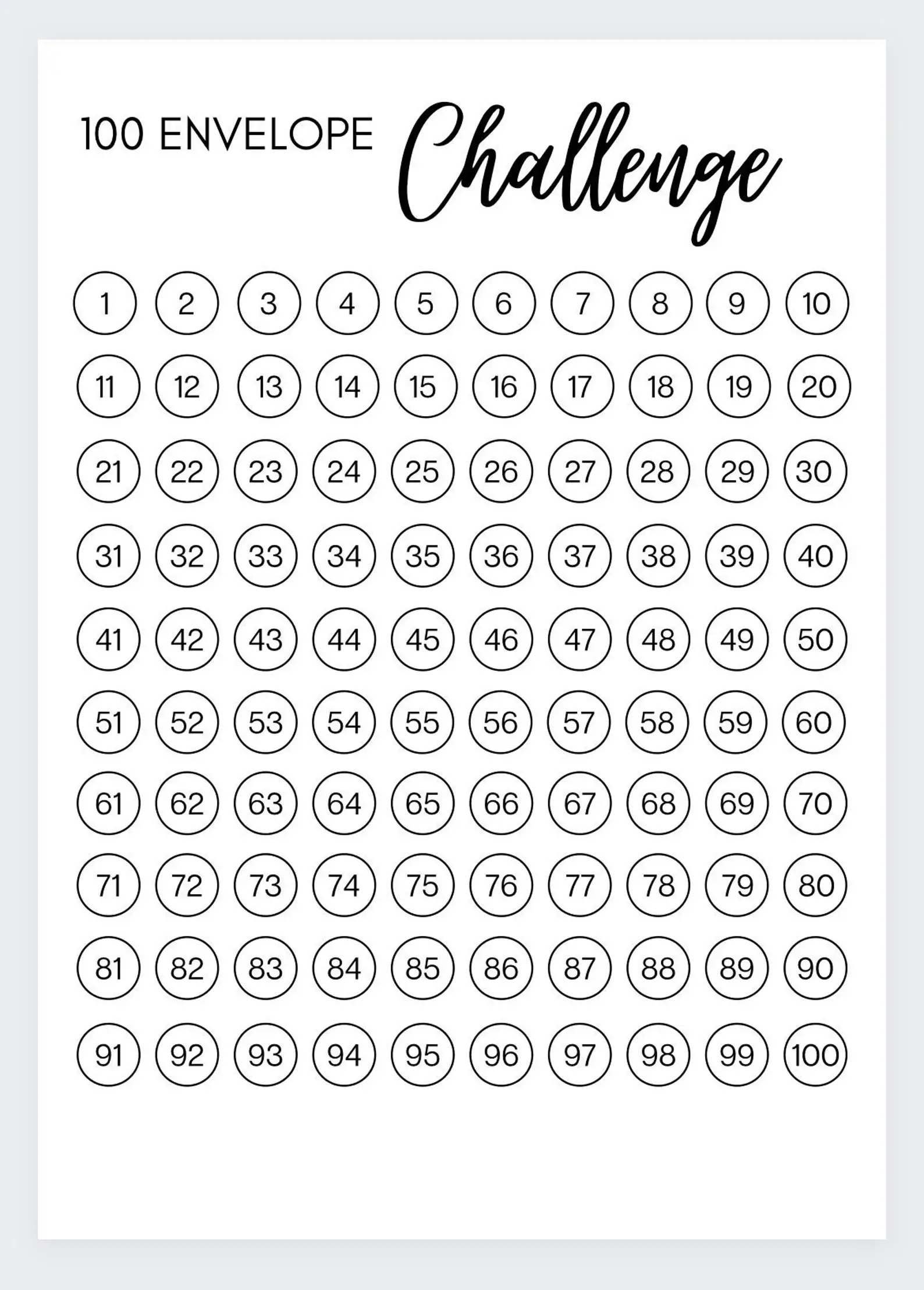

The 100 Envelope Savings Challenge is a simple, goal-oriented savings method. The concept is straightforward: label 100 envelopes with numbers from 1 to 100. Each number represents the dollar amount you’ll save. By the end of the challenge, you could potentially save $5,050!

This challenge has gained popularity because it’s a practical way to save a significant amount of money without feeling like you’re sacrificing too much at once. It’s perfect for anyone looking to build a savings habit or achieve a specific financial goal.

How Does It Work?

Here’s a step-by-step guide to help you get started:

Gather Your Supplies:

100 envelopes

A pen or marker to number the envelopes

A safe place to store your envelopes

Label the Envelopes: Write numbers from 1 to 100 on each envelope. For example, envelope #1 represents $1, envelope #2 represents $2, and so on up to envelope #100.

Set a Schedule: Decide how often you’ll pick an envelope—daily, weekly, or based on your budget. If you pick one envelope per day, the challenge will take 100 days to complete. If you choose weekly, it will take roughly two years.

Pick and Save: Randomly select an envelope and place the corresponding amount of money inside. For example, if you pick envelope #45, you’ll save $45 that day. Once you’ve added the money, seal the envelope and set it aside.

Track Your Progress: As you fill each envelope, keep track of how much you’ve saved. This will keep you motivated and ensure you’re on track to meet your goal.

Complete the Challenge: After all 100 envelopes are filled, count your savings. You’ll have $5,050 in total if every envelope was completed successfully.

Tips for Success

Adjust to Your Budget: If saving the higher amounts (e.g., $90-$100) feels too challenging, consider a modified version of the challenge with lower numbers.

Stay Consistent: Commit to the schedule you’ve set, even if it means picking smaller amounts during tighter financial periods.

Use the Savings Wisely: Plan in advance how you’ll use the money you save, whether for an emergency fund, vacation, or a big purchase.

Make It a Family Activity: Involve your family or partner to make the challenge more fun and collaborative. You can even turn it into a friendly competition.

Why Is It Effective?

The 100 Envelope Savings Challenge is effective because it’s:

Visual: Seeing your envelopes fill up provides tangible evidence of your progress.

Flexible: You can tailor the challenge to your financial situation and goals.

Engaging: The random selection adds an element of surprise, keeping you motivated.

Habit-Forming: By sticking to the challenge, you’re developing a consistent saving habit that can carry over to other areas of your finances.

Customizing the Challenge

While the traditional challenge involves envelopes numbered 1 to 100, you can customize it to better fit your needs:

Shorten the Challenge: If saving $5,050 feels overwhelming, try a smaller version, such as 50 envelopes numbered 1 to 50. This will help you save $1,275.

Use Digital Envelopes: If physical envelopes aren’t practical, consider using a digital savings tracker or an app. Transfer the corresponding amount to a savings account instead of cash.

Add a Goal: Define a clear purpose for your savings, such as paying off debt, starting an emergency fund, or saving for a vacation. Having a goal will keep you motivated.

Incorporate Rewards: Reward yourself at milestones (e.g., every 10 envelopes completed) to celebrate your progress and stay inspired.

Common Challenges and How to Overcome Them

Running Out of Cash: If you’re short on cash, focus on lower-numbered envelopes until your finances improve. The key is to keep the momentum going.

Forgetting to Save: Set reminders on your phone or calendar to pick an envelope regularly. Consistency is crucial for success.

Temptation to Spend: Store your envelopes in a secure location to reduce the temptation to dip into your savings prematurely.

A Real-Life Example

Let’s consider Sarah, a working professional who wanted to save for a dream vacation. Sarah decided to try the 100 Envelope Savings Challenge. She labeled her envelopes and picked one every week based on her paycheck schedule. On weeks when her expenses were high, she chose lower-numbered envelopes like #5 or #10. During months with fewer expenses, she challenged herself to pick higher numbers like #75 or #80.

Here’s a simple calculation to show how Sarah progressed:

Week 1: Picked #10 = Saved $10

Week 2: Picked #25 = Saved $25 (Total: $35)

Week 3: Picked #50 = Saved $50 (Total: $85)

Week 4: Picked #5 = Saved $5 (Total: $90)

Week 5: Picked #80 = Saved $80 (Total: $170)

By saving consistently and adjusting to her financial situation, Sarah managed to save a significant amount within months. By the end of the challenge, Sarah had saved $5,050. She used this money to book her dream vacation and still had some left for souvenirs. The structured yet flexible nature of the challenge made it easier for Sarah to stay consistent and achieve her goal without feeling stressed.

Printable Resource for Your Challenge

To help you get started, we’ve included a printable 100-day chart that you can use to track your progress. Each box on the chart represents one envelope, and you can cross off or color in a box every time you save the corresponding amount. This visual tool makes it easy to stay organized and motivated throughout the challenge.

Simply download and print the chart to start your 100 Envelope Savings Challenge today!

Success Stories

Many people who have completed the 100 Envelope Savings Challenge share inspiring stories of how it helped them achieve financial milestones. From paying off credit card debt to funding a dream vacation, the challenge proves that small, consistent efforts can lead to big rewards.

Conclusion

The 100 Envelope Savings Challenge is an excellent way to make saving money more exciting and manageable. Whether you’re saving for a specific goal or simply want to build better financial habits, this challenge is a great place to start. Why not grab some envelopes and give it a try today? With dedication and consistency, you’ll be amazed at how quickly your savings add up.