When it comes to building wealth through investing, one principle stands out: Time is more important than timing. Many new investors get caught up in the pursuit of finding the perfect moment to buy or sell, but the real secret lies in staying invested over the long term. This article explores the incredible benefits of long-term investing and why the length of time you stay in the market matters far more than trying to predict its highs and lows.

Why Long-Term Investing Works

Long-term investing leverages the power of compound interest and the natural growth of the market over time. Rather than trying to time the market, successful investors focus on staying consistent and patient, allowing their investments to grow steadily.

The Key Benefits:

Compound Interest: Reinvesting earnings generates exponential growth over time.

Market Recovery: Markets have historically rebounded from downturns, rewarding those who stay invested.

Reduced Emotional Decisions: Long-term investing minimizes the temptation to panic sell during market dips.

The Cost of Market Timing

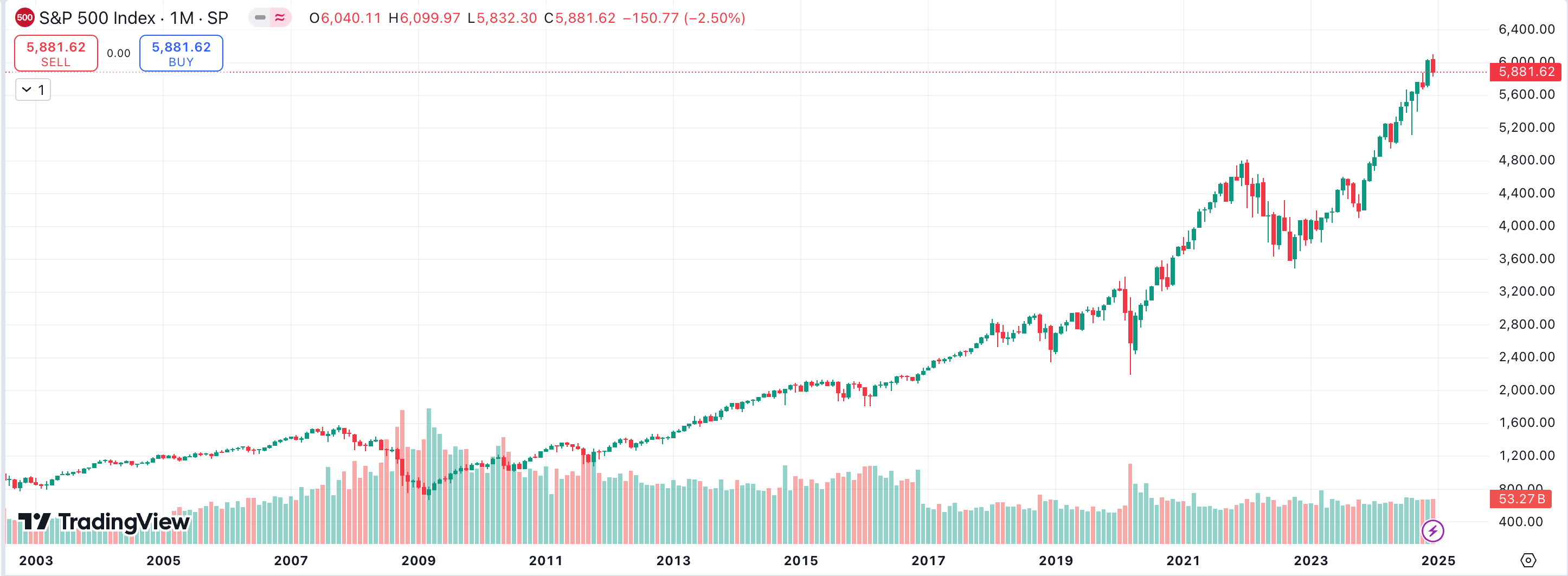

Trying to time the market can be a costly mistake. Even missing just a few of the market’s best-performing days can significantly reduce your returns.

Example:

If you invested $10,000 in the S&P 500 over 20 years, your portfolio could grow to $64,000 with an annualized return of 7%.

However, missing the market’s 10 best days during that period would reduce your portfolio’s value to $32,000—a 50% decrease.

Key Takeaway: Staying invested ensures you benefit from the market’s best days, which often follow downturns.

How to Start Long-Term Investing

Getting started with long-term investing is simpler than you might think. The key is to create a plan, stick to it, and let time do the heavy lifting.

1. Set Clear Goals

Define your long-term financial objectives. Are you saving for retirement, a child’s education, or financial independence? Clear goals will guide your investment strategy.

Actionable Tip: Write down your goals and break them into smaller milestones. For example, aim to save $500,000 by age 50 for retirement.

2. Start Early and Be Consistent

The earlier you start investing, the more time your money has to grow. Even small contributions can make a big difference over decades.

Example:

Investing $100 per month starting at age 25 with a 7% annual return could grow to $240,000 by age 65.

Starting the same at age 35 would result in only $120,000—half the amount.

Actionable Tip: Automate your investments to ensure consistency, no matter how small the amount.

3. Focus on Diversification

Diversification spreads your investments across different asset classes, reducing risk while allowing for steady growth.

How to Diversify:

Invest in a mix of stocks, bonds, and index funds.

Consider global markets to reduce dependence on a single economy.

Example: A young investor might allocate 80% to stocks and 20% to bonds, while a retiree might choose a more conservative mix.

4. Stay Invested Through Market Fluctuations

Market ups and downs are inevitable, but long-term investors know that time smooths out volatility. Historically, the stock market has trended upward over the long run.

Actionable Tip: Avoid checking your portfolio daily. Focus on your long-term goals instead of short-term fluctuations.

5. Use Low-Cost Index Funds and ETFs

Index funds and ETFs are excellent tools for long-term investing. They offer diversification, low fees, and exposure to the overall market.

Example: Investing in an S&P 500 index fund gives you exposure to 500 of the largest U.S. companies, spreading risk across multiple industries.

Actionable Tip: Research low-cost funds that align with your investment goals and risk tolerance.

Real-Life Example: Sarah’s Path to Financial Independence

Sarah, a 30-year-old software engineer, started investing $500 per month in a diversified portfolio of index funds. She ignored market dips and focused on consistent contributions. After 20 years, Sarah’s portfolio grew to $320,000, thanks to compound interest and staying invested. By age 60, her portfolio is projected to exceed $1 million, allowing her to retire comfortably.

The Myth of Perfect Timing

Many investors waste valuable time waiting for the “perfect” moment to invest. The truth is, no one can consistently predict market movements. What matters most is being in the market, not timing it.

Key Insight:

"Time in the market beats timing the market." This timeless advice underscores the importance of starting early and staying invested, regardless of short-term volatility.

Final Thoughts

Long-term investing is the most reliable way to build wealth and achieve financial goals. By focusing on time instead of timing, you can harness the power of compound interest and market growth to secure your financial future. Start today, stay consistent, and let patience be your greatest ally. Your future self will thank you.