When it comes to investing in the stock market, two dominant strategies often come into focus: short-term trading and long-term investing. While the allure of quick profits from frequent trading might attract many, historical data consistently highlights the superior benefits of holding stocks over the long term. To understand this better, let’s take a comparative look at the S&P 500—a benchmark for the U.S. stock market—over both short and long periods.

The Case for Long-Term Investing: Lessons from the S&P 500

The S&P 500 has delivered an average annual return of approximately 10% since its inception in 1926. However, this steady growth masks the short-term volatility that often defines the market. For instance, between 2000 and 2010, the S&P 500—sometimes referred to as the "lost decade"—produced a meager return of -0.95% annually when factoring in inflation. Short-term traders operating during this period would have faced significant challenges, reacting to market crashes such as the dot-com bubble burst and the 2008 financial crisis.

Contrast this with the following decade, 2010 to 2020, when the S&P 500 returned an average annualized rate of over 13.5%. Those who held their investments across both decades would have seen their portfolio recover and grow significantly over the 20-year span, demonstrating the resilience of long-term investing. Short-term trading, in contrast, often forces individuals to time the market—a notoriously difficult endeavor even for professionals.

1. Compounding Power: The Eighth Wonder of the World

Albert Einstein once called compound interest the "eighth wonder of the world." When you invest in stocks for the long term, you allow the magic of compounding to work in your favor. Compounding occurs when your investment earns returns, and those returns, in turn, generate additional returns.

For example, consider an investment of $10,000 in a stock with an average annual return of 8%. After 10 years, your investment would grow to $21,589. By 20 years, it would be worth $46,610, and after 30 years, it would reach $100,626. The longer you hold your investment, the more exponential the growth becomes.

Short-term trading, on the other hand, doesn’t leverage compounding in the same way. Frequent buying and selling mean you may miss out on reinvesting gains, which is a critical factor in building long-term wealth.

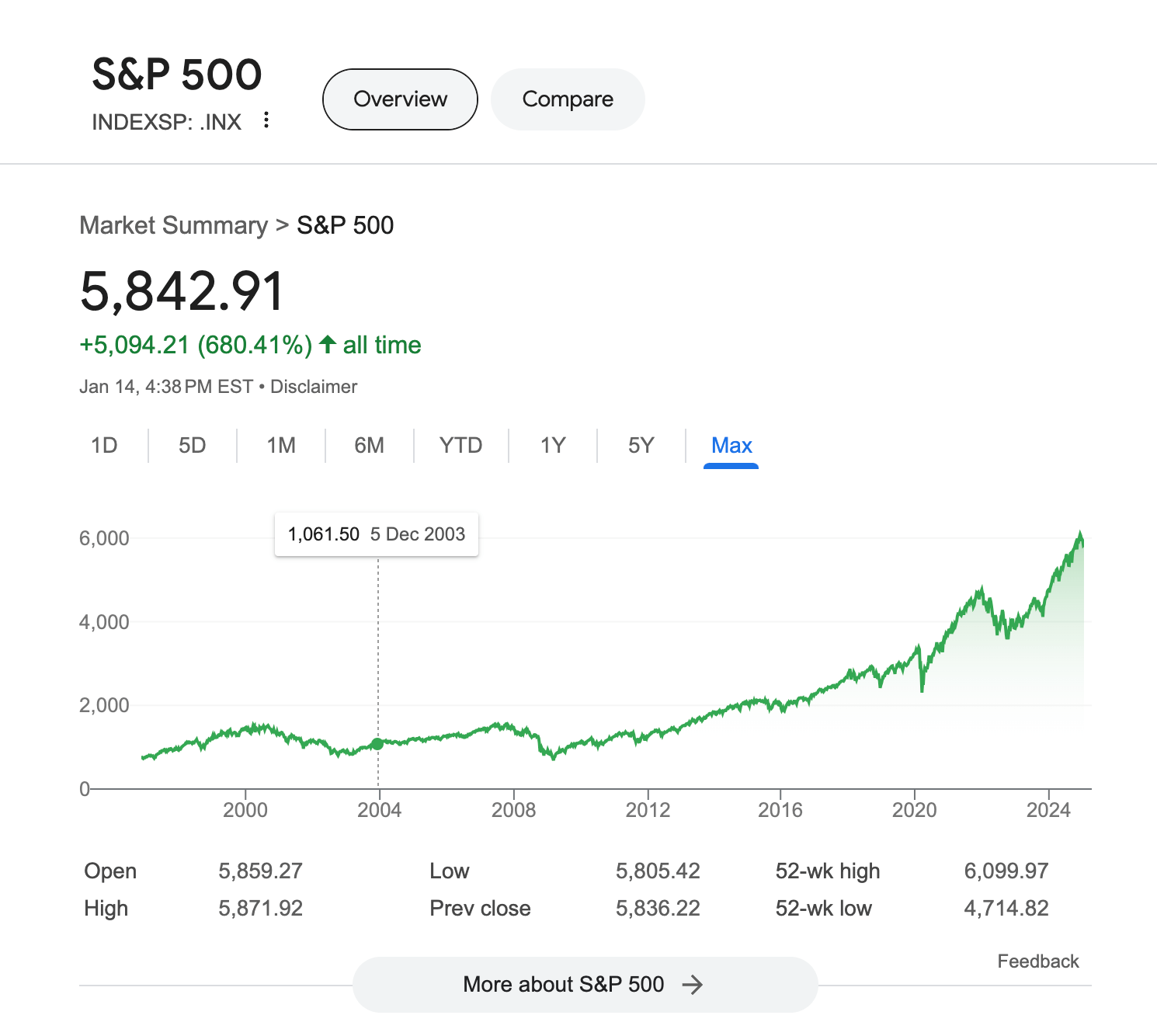

At 2004 the price is 1061.5, and now 2025 the price is 5842.91

the CAGR is 8.9% calculated by Investment Calculator

2. Reduced Transaction Costs and Taxes

Frequent trading comes with significant costs. Every transaction involves brokerage fees, and depending on the platform, these can quickly add up. Additionally, short-term capital gains—profits from selling assets held for less than a year—are taxed at a higher rate than long-term capital gains.

For instance, in the United States, short-term capital gains are taxed at the same rate as ordinary income, which can be as high as 37%. Long-term capital gains, however, are taxed at a lower rate, ranging from 0% to 20%, depending on your income bracket. By holding stocks for the long term, investors can minimize their tax liabilities and retain more of their profits.

3. Mitigating Market Volatility

Stock markets are inherently volatile in the short term, driven by factors like economic news, geopolitical events, and investor sentiment. This volatility can lead to significant price swings, making short-term trading both risky and stressful.

However, history shows that over longer periods, markets tend to rise. For example, the S&P 500, a benchmark index, has delivered an average annual return of about 10% since its inception in 1926. Despite periodic downturns, such as the 2008 financial crisis or the COVID-19 pandemic in 2020, the index has consistently recovered and reached new highs. Holding stocks long term allows investors to ride out these fluctuations and benefit from the overall upward trend of the market.

4. Lower Stress and Emotional Decision-Making

Short-term trading often requires constant monitoring of the market, which can lead to emotional decision-making. Fear of missing out (FOMO), panic during market dips, or greed during rallies can prompt impulsive actions that harm your portfolio.

Long-term investing, by contrast, promotes a more disciplined approach. By focusing on the fundamentals of the companies you invest in and ignoring short-term noise, you can make rational decisions that align with your financial goals.

5. Diversification and Risk Management

Long-term investors often have the opportunity to build a diversified portfolio, spreading risk across various sectors, industries, and asset classes. Diversification reduces the impact of poor performance in any single investment.

Short-term traders, who often concentrate their bets on a few stocks or sectors to capitalize on rapid price movements, may expose themselves to higher risk. If a trade goes against them, the losses can be significant and immediate.

6. Aligning with Economic Growth

When you invest in stocks, you’re essentially buying a stake in a company. Over time, as companies grow and economies expand, their value—and consequently, their stock prices—increases. Holding stocks long term allows you to participate in this growth.

For example, imagine investing in a company like Apple in the early 2000s. At that time, the stock price was under $5 (adjusted for splits). Fast forward to 2025, and Apple’s stock price has grown exponentially, generating massive returns for early investors. This kind of growth is rarely achievable through short-term trading.

7. Historical Data Supports Long-Term Investing

Numerous studies highlight the benefits of holding stocks long term:

A study by JPMorgan Asset Management found that missing just the 10 best days in the stock market over a 20-year period could halve your returns. These best days are often unpredictable and occur during periods of high volatility, underscoring the importance of staying invested.

Research from Dalbar Inc. shows that the average equity fund investor significantly underperforms the market due to poor timing of buy-and-sell decisions. Long-term investors who stay the course tend to achieve better results.

8. Dividend Growth and Reinvestment

Many long-term investments offer dividends, which are a portion of a company’s profits distributed to shareholders. Over time, these dividends can be reinvested to purchase more shares, further compounding your returns.

For example, suppose you own shares in a company that pays an annual dividend of $2 per share. If you reinvest these dividends, your share count will grow, leading to higher dividend payments in the future. This cycle creates a powerful snowball effect, enhancing your overall returns.